Atomic Number: 3

Symbol: Li

Name: Derived from the Greek word ‘lithios’ meaning stone

Atomic Number: 3

Symbol: Li

Name: Derived from the Greek word ‘lithios’ meaning stone

Lithium was discovered in 1817 by Johan August Arfvedson. It was discovered from a mineral, while other common alkali metals were discovered from plant material. This is thought to explain the origin of the element’s name; from ‘lithos’ (Greek for ‘stone’).

Lithium appears as a soft, silvery metal. It has the lowest density of all metals. It reacts vigorously with water.

Lithium has a variety of uses with the most important use of lithium found in rechargeable batteries for many consumer electronic devices such as mobile phones, laptops, digital cameras and electric vehicles.

Lithium metal has industrial applications and can be made into alloys with aluminium and magnesium.

Benefits:

Magnesium-lithium alloy uses:

Aluminium-lithium alloy uses:

Lithium oxide uses:

Lithium chloride (is one of the most hygroscopic materials known) uses:

Lithium stearate uses:

Lithium carbonate uses:

Lithium hydride uses:

Video of Lithium reactivity - https://www.rsc.org/periodic-table/video/3/Lithium?videoid=wY0afMI4Jgc

Lithium does not occur as the metal in nature, but is found combined in small amounts in nearly all igneous rocks and in the waters of many mineral springs. Spodumene, petalite, lepidolite, and amblygonite are the more important minerals containing lithium. The metal is produced by the electrolysis of molten lithium chloride and potassium chloride.

As a whole, the Earth's crust contains approximately 20 parts per million of lithium, and the oceans contain 0.17 parts per million; the atmosphere contains only trace amounts.

Lithium is highly reactive: lithium is highly flammable, and will even react spontaneously with water. (This high reactivity is why some lithium-ion batteries ignite or explode when exposed to high temperatures.) Instead, lithium is usually extracted from lithium minerals that can be found in igneous rocks (chiefly spodumene) and from lithium chloride salts that can be found in brine pools.

Currently the top producing Lithium countries are as follows (2015):

Currently the top Lithium reserve countries are as follows (2017):

Other noteable countries to mention: Bolivia – Hosts an enormous lithium deposit in Bolivia at the Uyuni Salt Flat (the world's largest salt flat). This massive resource remains untapped due to political and economic reasons.

Extracting lithium from brine is currently cheaper than mining it from spodumene, so there are many deposits of spodumene that are not currently being mined. Lithium is also present in seawater, but the concentration is too low to be economic.

While typical applications provide consistent demand, the biggest and fasted growing demand driver for lithium is the battery market.

Currently the largest demand drivers for lithium- ion batteries are:

Electirc Vehicles:

In 2015, approximately 500,000 cars sold in the United States had an electronic drive component (Only accounting for 1% of total Car sales in the US)

By 2040 it is estimated that 35% of all global sales will be Battery Electic Vehicles. Goldman Sachs estimates that a Tesla Model S with 70kWh battery uses 63 kilograms of lithium carbonate equivialent. For every 1% increase in battery electric vehicle market penetration, there is an increase in lithium demand by approx. 70,000 tonnes LCE/year.

Rechargeable Battery Market:

The estimated size of the rechargeable battery market in 2014 was US$49 Billion with the Lithium- ion battery accounting for 33.4% of that value. It is estimated that by 2025 the rechargeable batter market with be US$112 Billion wht Lithium-ion accounting for 70% of that value.

The Future for the lithium market also includes power storage by way of the “Smart Grid” which are said to be the future of power distribution in cities. The Smart Grid uses computers to improve efficiency and flexibility of power distribution:

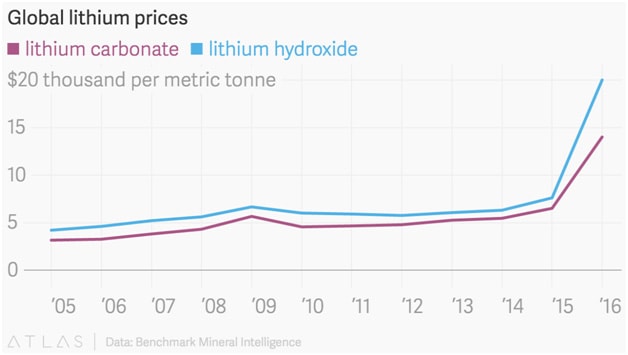

Lithium pricing can range from SPOT and contract pricing.

Lithium SPOT pricing can be found here: https://price.metal.com/prices/other-minor-metals

Lithium contract pricing ranges depending on the agreement between the producer and the purchaser.

Lithium Brine Deposits:

Hard rock exploration:

Resources

[1] J. Emsley, Nature's Building Blocks: An A-Z Guide to the Elements (Oxford University Press, 2002).