November 2024

Argentina Lithium uniquely positioned to rapidly advance key projects covering over 70,000 hectares in the Lithium Triangle.

Few explorers are set up to deliver like Argentina Lithium & Energy Corp. (TSXV: LIT; OTCQX: LILIF). This is not just luck -- these advantages are being earned.

- In October 2023, Peugeot Citroen Argentina S.A. – a subsidiary of Stellantis N.V, a leading automaker globally – acquired 19.9% of LIT’s Argentine subsidiary, which is convertible to ownership in the parent company.

- So far, it looks like Stellantis – a company built by mergers and acquisitions -- made a smart strategic investment. LIT’s leading project, Rincon West, has hit moderate to high lithium values on all 13 of the holes it has drilled, with most over long intervals.

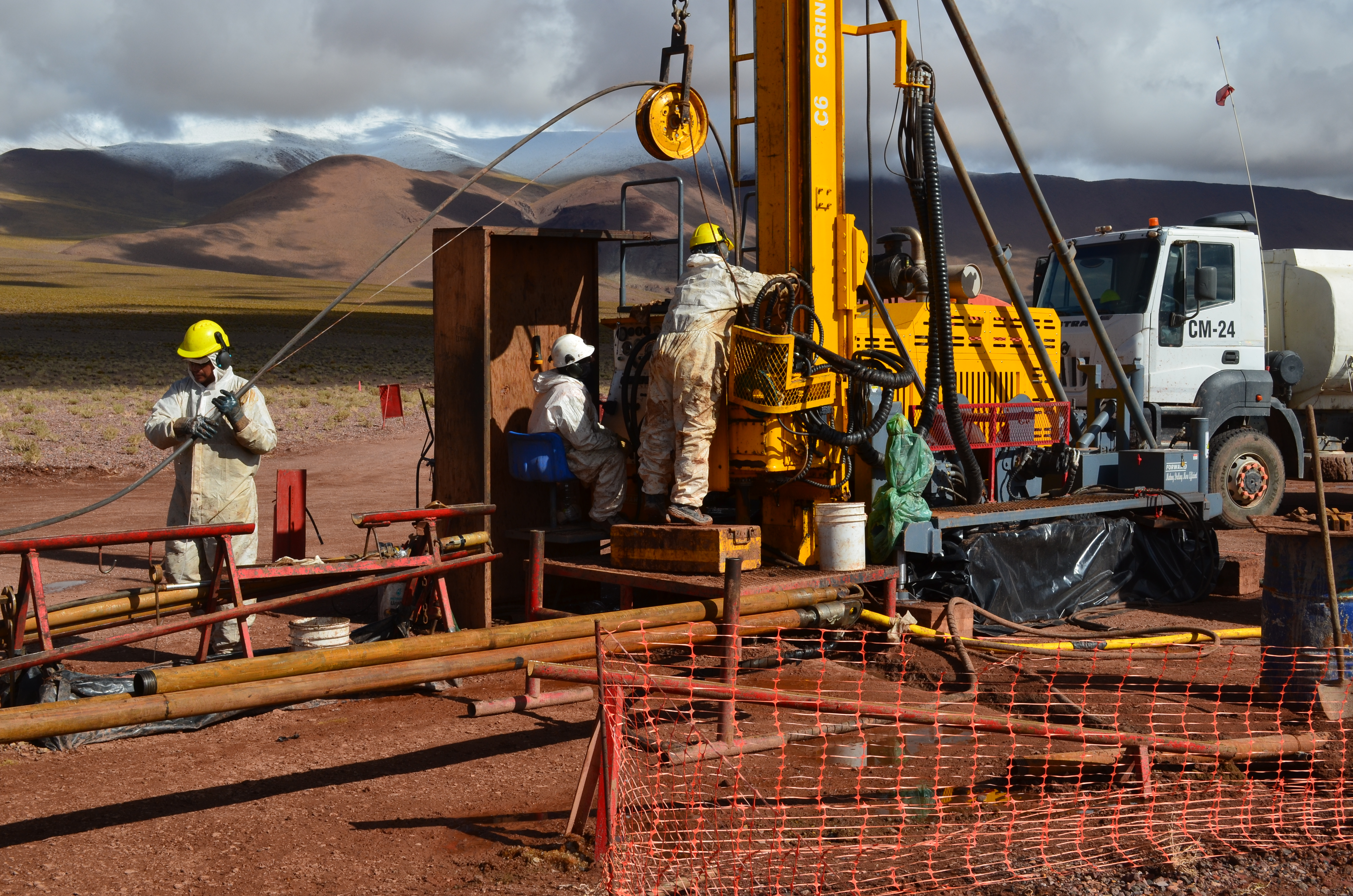

This speaks well for the potential here. To advance Rincon West, six holes are being drilled at the Paso de Sico property, adjacent to Rio Tinto on the north, another 6 holes are pending a drilling permit to drill at the Don Fermin property on the east side of the Rio Tinto, plus pump testing is anticipated prior to year-end. If merited, LIT can report its first resource estimate soon.

- Rincon West covers +5,000 hectares at the Rincon salar in far northwestern Argentina. It lies adjacent on three sides to Rio Tinto’s large project covering most of the salar. Both Rio Tinto (www.riotinto.com) and another company on the salar, Argosy Minerals (www.argosyminerals.com.au), have produced lithium carbonate on-site at the demonstration level and have stated they will be producing lithium carbonate commercially near-term.

- Stellantis’ investment includes an offtake agreement of up to 15,000 tonnes/year of lithium over 7 years in the event LIT achieves production. And the offtake can be extended. LIT has a qualified buyer.

- Importantly, LIT has prepaid for up to 15,500 meters of drilling services, anticipated to be adequate to cover drilling requirements on all its projects for the next two years. This is a rare advantage most explorers can only dream about.

The company is a member of the Grosso Group, a resource management group that has pioneered exploration in Argentina since 1993 and has been involved in four major discoveries in Argentina.

- It also helps to understand that management has a long history of success in the resource sector of Argentina and has drawn together some of the most prospective lithium properties. LIT was there before most other companies, and has long-term relations throughout the mining sector, and with government officials and communities.

Additional concessions

Argentina Lithium also controls +13,000 hectares just north of Albemarle – one of the world’s largest lithium producers -- on the Antofalla salar. Here, 67 line-kms of Transient Electromagnetic soundings, TEM, were recently completed and permitting is underway to initiate the company’s first six-hole drill program at Antofalla North.

LIT controls +26,000 hectares at the Pocitos salar, approx. 20% of the salar, south of Rincon. Here, the company has completed 170 line-kms of Transient Electromagnetic soundings to detect and delineate brine concentrations. The company plans up to a 4-hole drill program here. Several other companies are exploring sections of Pocitos.

LIT controls approx. 90% of the Incahuasi salar, +25,000 hectares, in Catamarca province. Here, the company plans a TEM geophysical survey near-term to supplement exploration initiated in 2018.

The lithium market

As with all commodities, the lithium market is cyclical. It is likely emerging from a two-year down market now. The key lithium and lithium battery ETFs – LIT, LITP, BATT, ILIT – all bottomed on September 10 this year and have moved up sharply since then. This is probably not a coincidence.

And it’s no wonder. The need for lithium and lithium batteries to fuel the green revolution – electric vehicles and energy storage – is still increasing strongly every year.

As one example, respected international management consultant, McKinsey & Company, reporting in 2023, projects 27% annual growth for lithium batteries through 2030 -- from 700 gigawatt hours (Gwh) in 2022, to 1700 Gwh in 2025, to 4700 Gwh in 2030. Western sources of lithium are likely to get seriously challenged.

Three-way opportunity converges

While Stellantis has discovered Argentina Lithium, public markets have not. Market capitalization is approx. C$23 million.

The potential here is very appealing, combining undiscovered values, serious advantages with exploration in just the right places, as the lithium market is starting its turn.

For more information, speak with Shawn Perger,

perger@grossogroup.com, 778-686-0135

(Note that proximity to a discovery, mineral resource, or mining operation does not indicate that mineralization will occur on the Company’s property, and if mineralization does occur, that it will occur in sufficient quantity or grade that would result in an economic extraction scenario.)

Nightime drilling at Rincon West - photo credit A. Soliz.

Geologists prepare a small submersible pump for a well test at Rincon West - photo credit A. Soliz.

Brines are sampled at regular intervals during drilling. An inflatable 'Packer' is lowered down the bore to seal the interval for sampling.